Investors are starved for yield, we want them to be careful…

In the current low interest rate environment, many investors are struggling to achieve their income targets and will often reach for yield to make up for any shortfalls. In a fixed income portfolio, this reach for yield can be accomplished in two distinct ways: extending duration or moving down in credit quality.

The main reason to own fixed income as part of an asset allocation strategy is to reduce overall portfolio volatility and specifically, provide ballast during periods of equity market stress. Bonds of the highest investment grade, specifically US treasuries and municipals, historically have served this purpose the best.

Meanwhile, fixed income investments that offer a higher yield carry additional risk, including some that we believe are often overlooked. Many investors in today’s market are so fascinated by seeing yields over 5% on a bond fund that they will jump right in (remember the 10-year treasury is paying just 2.85% right now). Funds offering these robust yields generally fall into the category of junk, or high-yield debt and almost exclusively hold below investment grade debt, are inherently more risky and often trade like equities.

JNK, the Barclay’s High Yield Bond ETF, and HYG, the iShares iBoxx High Yield Corporate Bond ETF, are two ETFs that fall into this category, both yielding over 5%. Specifically, these two funds hold high-yield corporate bonds, comprised of approximately 80% US and 20% international issues.

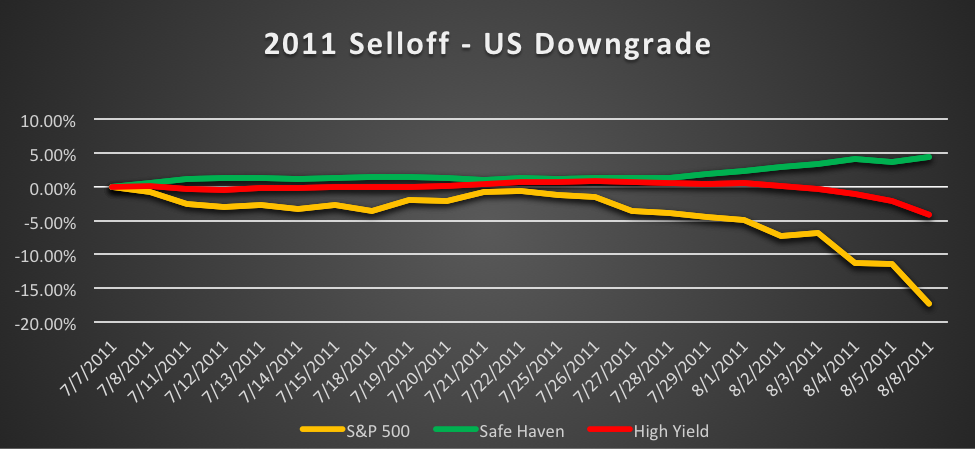

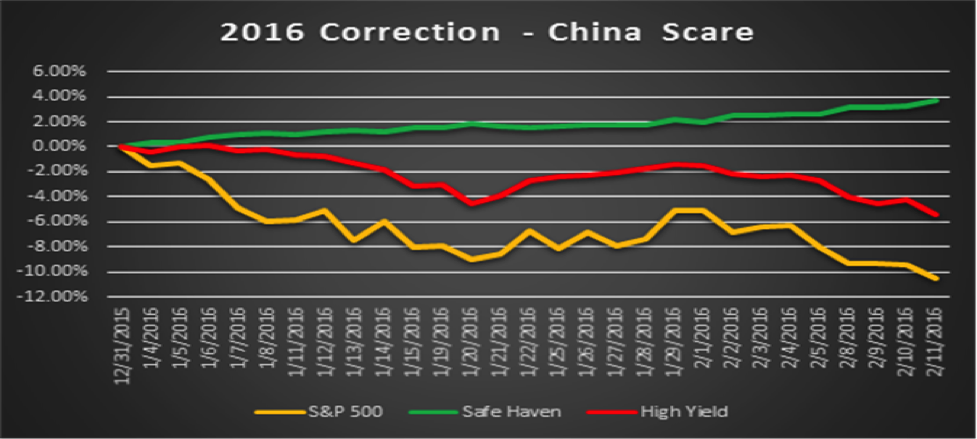

The graphs below show 3 periods in the past 10 years when equity markets experienced substantial stress. During those same time frames, we included the performance of safe haven bonds (US treasuries and municipals) and these high-yield bond funds for comparison:

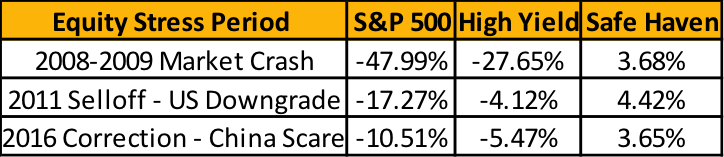

The below chart further summarizes how each asset group performed during these periods:

The crucial takeaway here is that high yield bonds provided little ballast to a portfolio during these periods as they behaved more like equities. For investors with shorter time horizons, losses like this are difficult to absorb. Meanwhile, safe haven bonds served their purpose and provided gains during all 3 periods. Investors in these types of bonds were able to sleep at night.

Are You Being Properly Compensated for the Risk in High Yield?

We have already established that historically, high yield bonds do not offer much protection in the event of a significant equity market correction. Since the bond is not playing the role of a safe haven security, then one would hope you are being compensated with additional yield for the step up in credit risk.

We can evaluate the magnitude of this compensation through another key indicator many fixed income investors use – credit spreads. Credit spreads are the difference in yield between two bonds of similar maturity but different credit quality. Basically, it’s a measure of how much investors are getting paid for taking on additional credit risk when buying a certain type of bond versus an equivalent US Treasury.

Looking specifically at BB rated corporate bonds, the current credit spread is 211 basis points (2.11%), hovering near the low since the financial crisis, as shown below:

For comparison, during the financial crisis, BB corporate spreads approached 1500 basis points! In short, investors in today’s environment are stretching for yield in securities that are already quite expensive relative to historical levels and may not be getting fair compensation for taking on the credit risk embedded in a BB rated bond. Sure, these types of bonds are a useful compliment to a core fixed income allocation but be careful of overreaching for yield and leaving your portfolios even more exposed to equity market-like volatility.

Just like there are different types of stocks that can be employed to accomplish different goals, bonds are no different. It is important to make the distinction so investors can set reasonable expectations for their bond portfolios, especially during periods of equity market stress when balance and diversification are needed most.

Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities. Full disclaimer.