The stock market is down another 2% today after the S&P 500 had already fallen a combined 6% on Monday and Tuesday. As you probably know, the reason behind the market’s recent swoon is growing global concern about the potential impacts of the coronavirus and its spread outside of China to Europe and here in the U.S. Fears of contagion are causing the cancellation of travel, school and other events in certain parts of the world and interconnected global supply chains have already been disrupted. At the very least, these developments will likely have a significant impact on 1st quarter corporate earnings and the global economy even if health officials find some level of containment over the next several weeks.

While it is our expectation in the near-term to see more negative headlines than positive regarding the spread of the virus, we are cautioning clients to avoid making any rushed decisions based on the volatility we have seen and what we might see over the coming weeks. In fact, periods like this serve as a perfect reminder for everyone to reassess their risk tolerance in relation to their long-term goals and existing portfolio allocations. It is entirely fair and warranted to step back during a week like this and assess how the last few days of volatility have made you feel but it’s important to do so within the lens of your longer-term goals and remember that your portfolio was built to absorb times like these.

Some historical context could prove helpful here:

- As mentioned above, the S&P 500 fell by 6% over the course of Monday and Tuesday. This is the first time such a sudden drop has occurred since 2015 and only the 34th instance since 1950 where the index fell by 6% or more within two trading sessions.

- When we looked out a year later after these 34 instances, we found that the S&P 500 had logged positive performance in 30 of the 34 and had advanced by an average of nearly 17%.

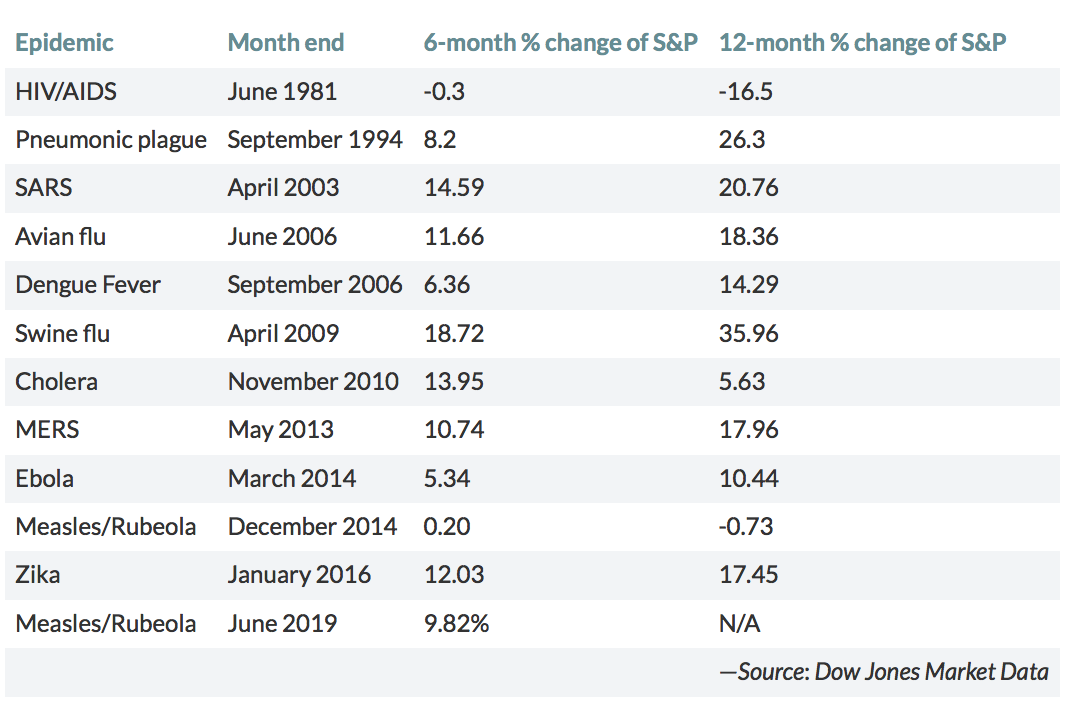

- A look back at past public health epidemics shows the market has held up quite well following these bouts of extreme uncertainty. Going back to the onset of the HIV/AIDS scare of the early 80s, the market has generally shown strength over the following 6 to 12 months (chart below).

By sharing these statistics we are by no means suggesting that we should write-off the coronavirus as a non-event. Historical precedent is certainly nice to have but we will not draw any fixed conclusions on how the virus’ will impact stocks because markets can and will react unpredictably to the unknown. For instance, China’s share of the world economy today is much bigger than when SARS (also originated in China) broke out in the early 2000s. Further, coronavirus gained traction during the Lunar New Year and likely severely impacted peak travel and consumer spending season throughout Asia. These facts, along with a host of others that are unfolding in real-time, will reverberate throughout the global economy and into corporate earnings here in the United States but what’s currently impossible to know is: How much will it impact the economy? And for how long?

While those questions might be discomforting to ponder they must be balanced out with the understanding that what global health scares also do is create pent-up demand. People are likely to cancel some travel here in the near-term but their longer-term travel budget is not likely to change. They will eventually take that trip. And supply chain disruptions may cause the price of an item to rise here in the short-term and keep us from buying it next month but supply will eventually come back online and prices will fall back to their normal level. Pent-up demand will then be unleashed.

We as investors tend to concentrate on the immediate, short-term effects during situations like we are seeing today. It’s human nature to feel skittish on days when you walk past the television and see the Dow down 700 points but it’s also critically important to remember that your portfolio was built knowing that “scary” times would happen. We didn’t know the exact “why” or the exact “how” but we knew they would come. While the severity of the virus will ultimately dictate what the market does over the next several weeks, take comfort in knowing that your portfolio was constructed with an expectation that uncertain times would occur. Today, the coronavirus is a public health/humanitarian issue and potentially a severe one at that. However, it is not a reason for long-term investors to adjust their portfolios.

If at any point you have realized that you are uncomfortable with the level of risk in your investment portfolio or would like to more clearly understand how your portfolio is aligned with your longer-term values and goals, please do not hesitate to reach out. We know weeks like these can feel scary and we are here to talk through whatever concerns you might have.