At its core, factor investing is a form of quality control. You have a set of criteria, or factors, that you believe are indicative of a stock’s success, and choose your investments by ranking companies based on these specific factors.

Factor-focused investing may look at a number of different factors when choosing what stocks to buy, there are usually two categories under which these factors fall under: macroeconomic and style factors. The former can include things like a company’s credit, inflation rates, and liquidity, while style factors can include things like a stock’s current momentum (or upward growth), it’s volatility on the market, and a company’s size and quality (its financial health). This differs from traditional index funds, such as the S&P 500, which sorts companies and their percentage of the index according to their size. This “average” approach to investing skews your investment dollars to the largest of stocks regardless of their merits.

Diversification

Factor investing is designed to minimize risk by increasing a portfolio’s diversity, and as most of us know diversification is the key to a successful long-term investment strategy. The reason why factors help to ensure a diversified portfolio is because the factors cover a wide variety of scenarios and are therefore more likely to perform well at different parts of the economic cycle. So, if one factor is currently underperforming, there’s a good chance that another factor is doing well as a result.

Potential to Maximize Returns

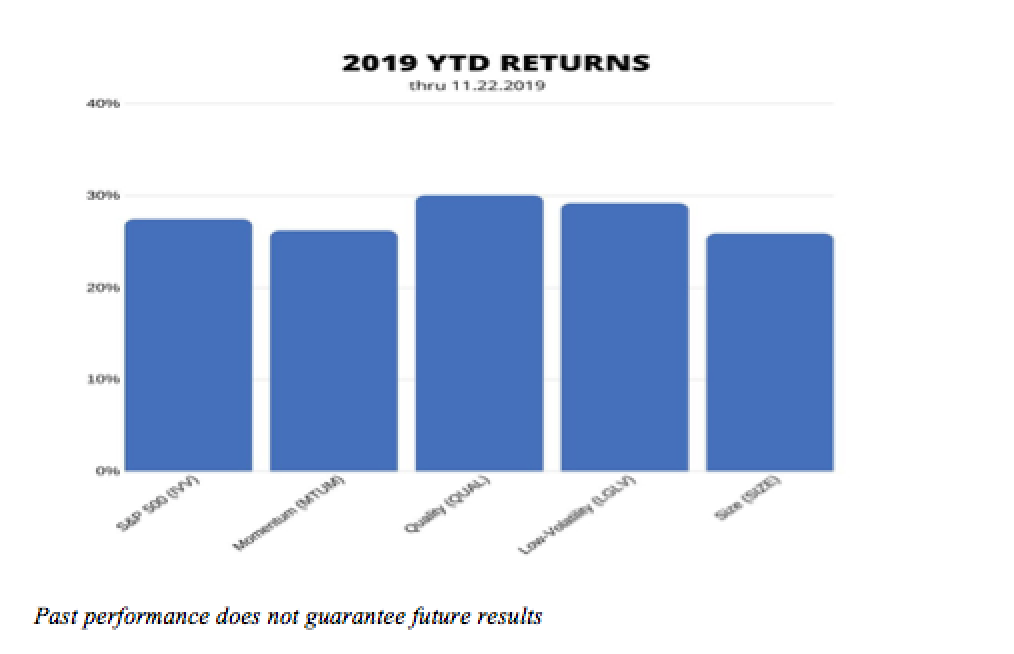

Fundamentally, factors tend to encompass traits that have historically driven high and consistent returns. When combined with strategic factor selection – based on what you think will increase the likelihood of a stock’s above-average performance – they can be used to drive portfolio alpha (excess returns above the index). Below is an example of how some factors – investing in US stocks have performed year-to-date vs. the S&P 500 index.

As you can see from the chart above more defensive factors QUAL and LGLV have out-performed the index and momentum stocks thus far in 2019. Our internal investment committee works closely with our institutional research partners to form opinions on certain traits we believe will out-perform given the market and economic environment. We then implement changes in client portfolios accordingly with the goal of minimizing risks and maximizing returns.

As always, to existing clients THANK YOU for your trust in us, we will continue to work for you everyday to protect you in the moment and plan for your future.

Written by: Chris Thomas, CFP®, AIF®, CPFA – Director MacroView Personal Wealth Management.

For more on factor investing visit: BlackRock: What is Factor Investing?