Confusing Coupon and Yield Could be Costing Your Clients

Two key features for individual bond investors to pay attention to are coupon and yield. Coupon represents the annual cash flow an investor will receive as the bondholder. For example, an investor who owns a bond with a 4% coupon will receive $4 in interest annually. In comparison, an investor who owns a bond with a 5% coupon will receive $5 in interest annually. This interest payment is a fixed amount that will not change. So why would anyone ever buy the 4% coupon bond if the 5% coupon pays more? The reason is that coupon does not equate to the total return an investor receives while owning a bond.

The actual return is reflected in a bond’s yield, or the average annual return an investor receives if the bond is held to maturity or call. When buying bonds for clients, yield, not coupon, should be prioritized.

In the above example, if every investor wants to buy the 5% coupon bond over the 4%, supply and demand stipulates that the price of the 5% bond will be higher than the 4% bond. In other words, the 5% bond will be priced at a premium over the 4% bond.

Economic equilibrium implies that these two bonds should be priced such that an investor is indifferent between purchasing the 4% and 5% bond, since the yield (return) should be the same. This price-coupon relationship is how the bond’s yield is ultimately calculated.

The Math

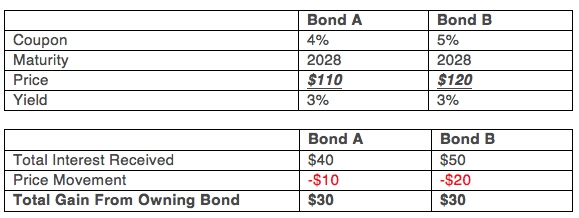

The above tables outline how the price-coupon function plays out.

Bond A pays $40 in interest over the life of the bond (4% per year for 10 years). The bond is priced at $110, a slight premium, as it carries an above market coupon. Since the investor receives par value ($100) at maturity, this bond will lose $10 in price over its life. This results in a net gain of $30.

Bond B pays $50 in interest over the life of the bond (5% per year for 10 years). The bond is priced at $120, a significant premium, as it carries a well above market coupon. Since the investor receives par value ($100) at maturity, this bond will lose $20 in price over its life. Again, this results in a net gain of $30.

This example shows an investor’s indifference between owning these two bonds, in theory. However, in reality, investors are willing to pay even more of a premium for the extra coupon. Thus, the 5% coupon bond is priced such that the yield is LESS than the 4% coupon bond.

That is correct, buying a 5% coupon and holding the bond to maturity is actually costing your client in total return when compared to buying a 4% coupon.

This difference in yield you receive between the two coupons is called the spread.

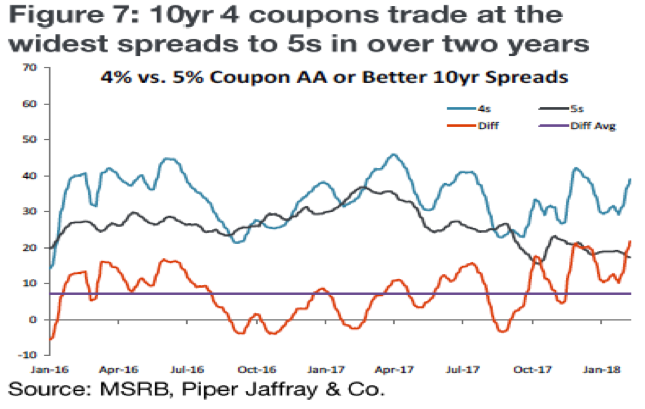

Our friends at Piper Jaffray put together the above chart. The chart shows the current spread in yield between a 4% and 5% coupon bond in the municipal market. This spread of about 20 basis points (0.2%) is at the highest level in 2 years.

Said differently, by moving down just 1% in coupon and still earning above market cash flows, you can increase your yield by 20 basis points per year. In the callable municipal bond space, where we prefer to participate, this spread is currently sitting upwards of 40 basis points per year. A simple move down in coupon is a tactical adjustment we have been making for our clients as these spreads have widened and value has emerged.

While investors might get excited to receive a 5% coupon in the current low-rate environment, they may not realize this extra cash flow over the long run is costing them dollars in their pocket because of the significant premium paid to receive this cash flow. To learn more about how we can provide value to you and your clients, you can visit us at www.macroviewim.com or call 301-907-6795.

Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities. Full disclaimer.